Choosing the right IDV is now easier than ever with online insurance platforms that offer instant, personalised estimates with IDV calculators. Even a brand-new car sees a 5% depreciation as per Insurance Regulatory and Development Authority of India (IRDAI) rules, making accurate IDV selection crucial from day one during insurance purchase or renewal.

Here, we will explore how insurers simplify the IDV calculation process through customisation, digitisation, and online tools. So, keep reading if you want to choose the right IDV for your car!

The primary aspect of modern insurance platforms is their digital-first approach and dependence on data to serve their customers. The three pointers below explain how modern insurance platforms help their customers in getting the right IDV for their cars:

The importance of data in calculating several aspects of insurance investments has increased over time. Every person has become more and more calculative about what kind of insurance they are going to invest in for their vehicle.

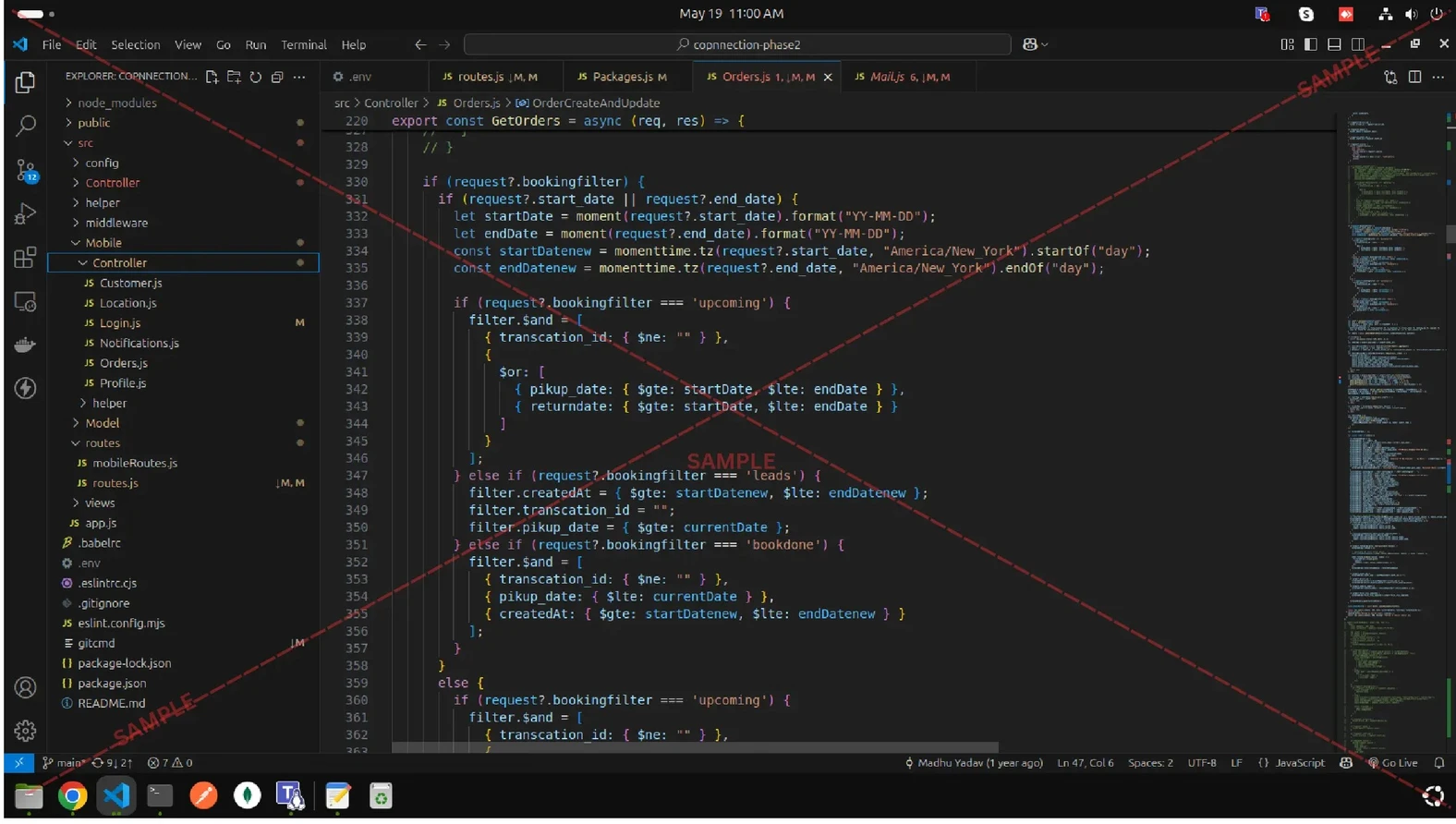

Calculating IDV investment for their cars comes alongside. Modern insurance platforms have provided their customers with an easy online tool to help them calculate IDV in just a few clicks.

They do this with the help of IDV calculators. IDV calculator is a tool that takes in a few basic details of your car and gives you an accurate estimate of the IDV, which may best suit your car’s specifications.

The details that these calculators depend on generally include:

Adoption of online insurance products has grown as they are convenient to use and available for individuals in India. According to a 2024 analysis, the Online Insurance Market in India accounted for approximately 4% in India in 2023.

This shows the increased use of online insurance firms, which is in tandem with the digital-first strategy of the majority of contemporary insurance websites today. So, now, when you need to know the IDV of your vehicle, you simply require a good internet connection and some clicks.

Personalising the extent of IDV you want for your vehicle is also something that these new insurance portals provide. You can increase the IDV value of your vehicle, and concurrently, your insurance premium will also increase marginally to accommodate the IDV increase.

This personalisation brings you the authority to control the level of your premiums and meet the needs of your vehicle.

For instance, if you have a car that is three years old and are planning to buy a new one, then you can opt for a lower IDV if you want to maximise your investment in the new car.

Suppose you have purchased a brand-new Tata Punch Pure (petrol) in Howrah, West Bengal. It will cost you approximately ₹7.73 lakh. Now, you wish to avail a maximum IDV for your vehicle to safeguard yourself financially in the event of total loss.

So, in order to find out the best IDV, you make use of an IDV calculator. The calculator requests simple information like the car's:

On this basis, it computes the optimal IDV of your vehicle from pre-set depreciation percentages.

IRDAI has established a 5% depreciation rate for brand new vehicles with an age of below 6 months. Hence, the highest IDV that you can obtain for your Tata Punch will be around ₹7.35 lakh.

This illustration demonstrates how using an IDV calculator makes it easier, allowing you to make a well-informed choice by providing a reasonable and accurate IDV.

| Do’s | Don’ts |

| Research the current market price of the vehicle. | Never select a lower IDV just to save on the insurance premium amount. |

| Keep the age and depreciation rates in mind. | Do not forget to review IDV when renewing insurance. |

| Select a higher IDV if you retain the vehicle in the long term, and opt for a lower IDV to save money if you plan to sell immediately. | Never overlook the IDV evaluation criteria of your insurer. |

Even for a brand new vehicle, you will only receive up to 95% of its value as IDV as per depreciation allowed by IRDAI. That is why it is important that you calculate your IDV precisely. New-age online insurance websites make this easy for you with features such as IDV calculators. Use them judiciously to get the right balance between the vehicle's cover and your premium.

More News Click Here

Discover thousands of colleges and courses, enhance skills with online courses and internships, explore career alternatives, and stay updated with the latest educational news..

Gain high-quality, filtered student leads, prominent homepage ads, top search ranking, and a separate website. Let us actively enhance your brand awareness.