Are the courses 100% online?

+

Yes, all courses are fully online and can be accessed anytime, anywhere through a smart web or mobile device.

When can I start a course?

+

You can start any course immediately after enrollment, without any delay.

What are the course and session timings?

+

As these are online courses, you can learn at any time of the day and for as long as you want. We recommend following a routine, but it ultimately depends on your schedule.

How long do I have access to the course materials?

+

You have lifetime access to the course materials, even after completion.

Can I download the course materials?

+

Yes, you can access and download the course content for the duration of the course and retain lifetime access for future reference.

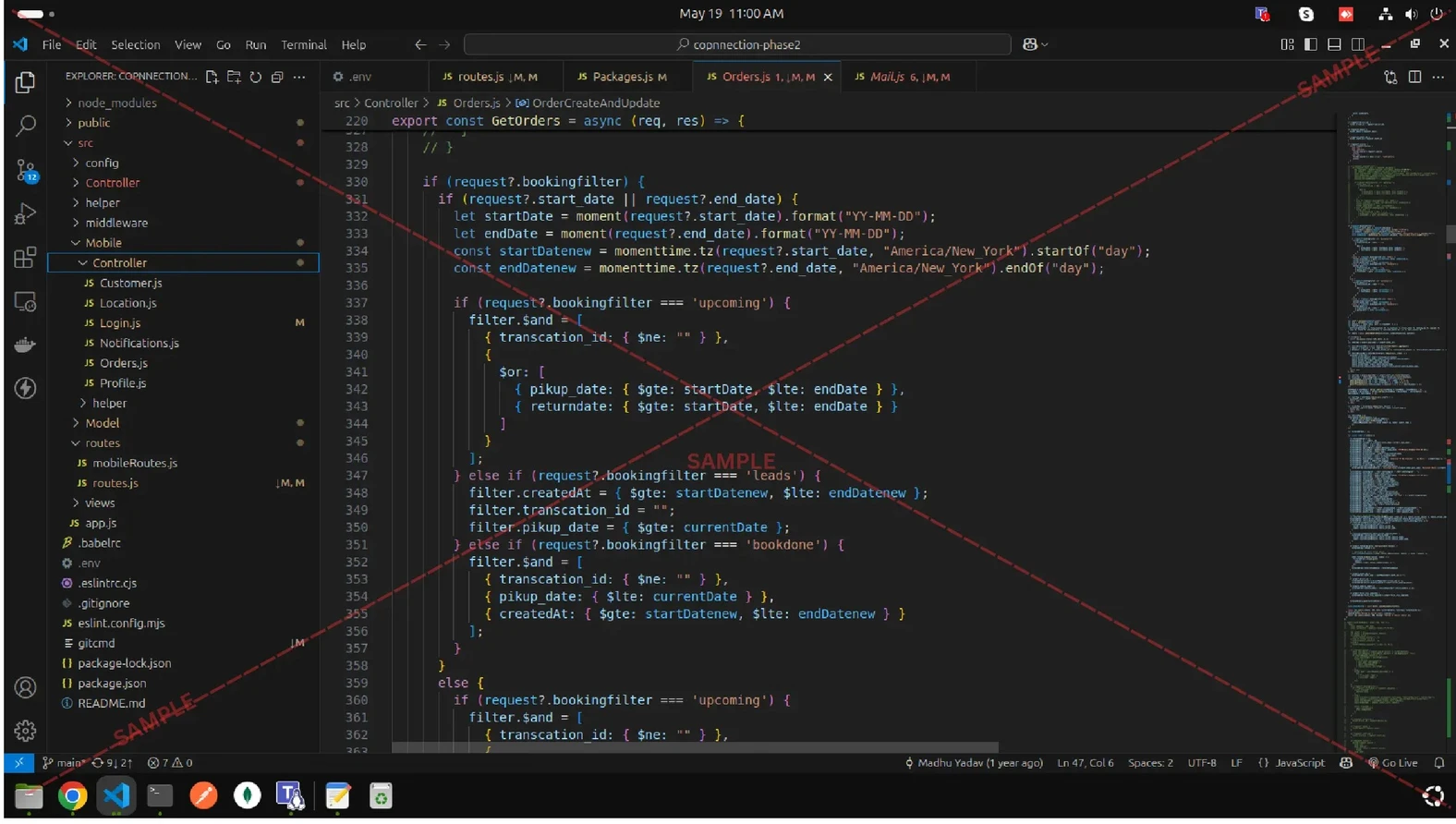

What software/tools are needed for the courses?

+

Any required software or tools will be shared with you during the training as and when needed.

Can I do multiple courses simultaneously?

+

Yes, you can enroll in and pursue multiple courses at the same time.

Are there any prerequisites for the courses?

+

Prerequisites, if any, are mentioned in the course description. Many courses are designed for beginners and have no prerequisites.

How are the courses structured?

+

Courses typically include video lectures, reading materials, quizzes, and assignments. Some may also include projects or case studies.

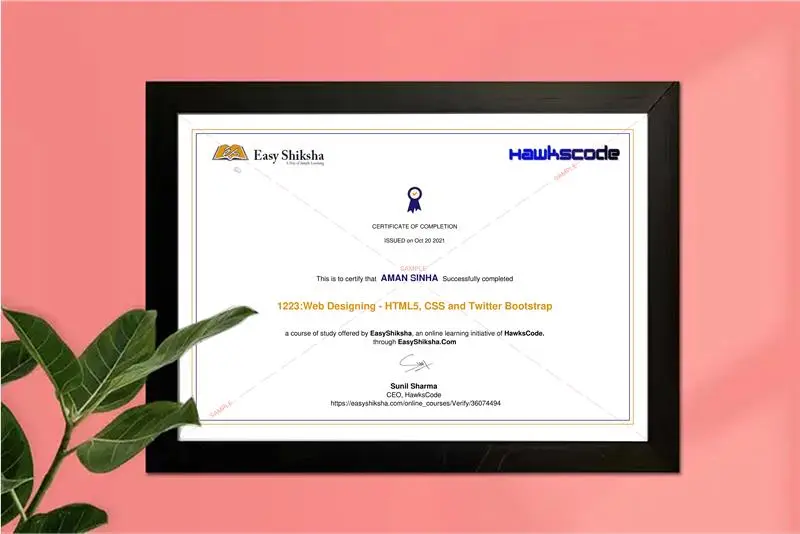

Are EasyShiksha certificates valid?

+

Yes, EasyShiksha certificates are recognized and valued by many universities, colleges, and employers worldwide.

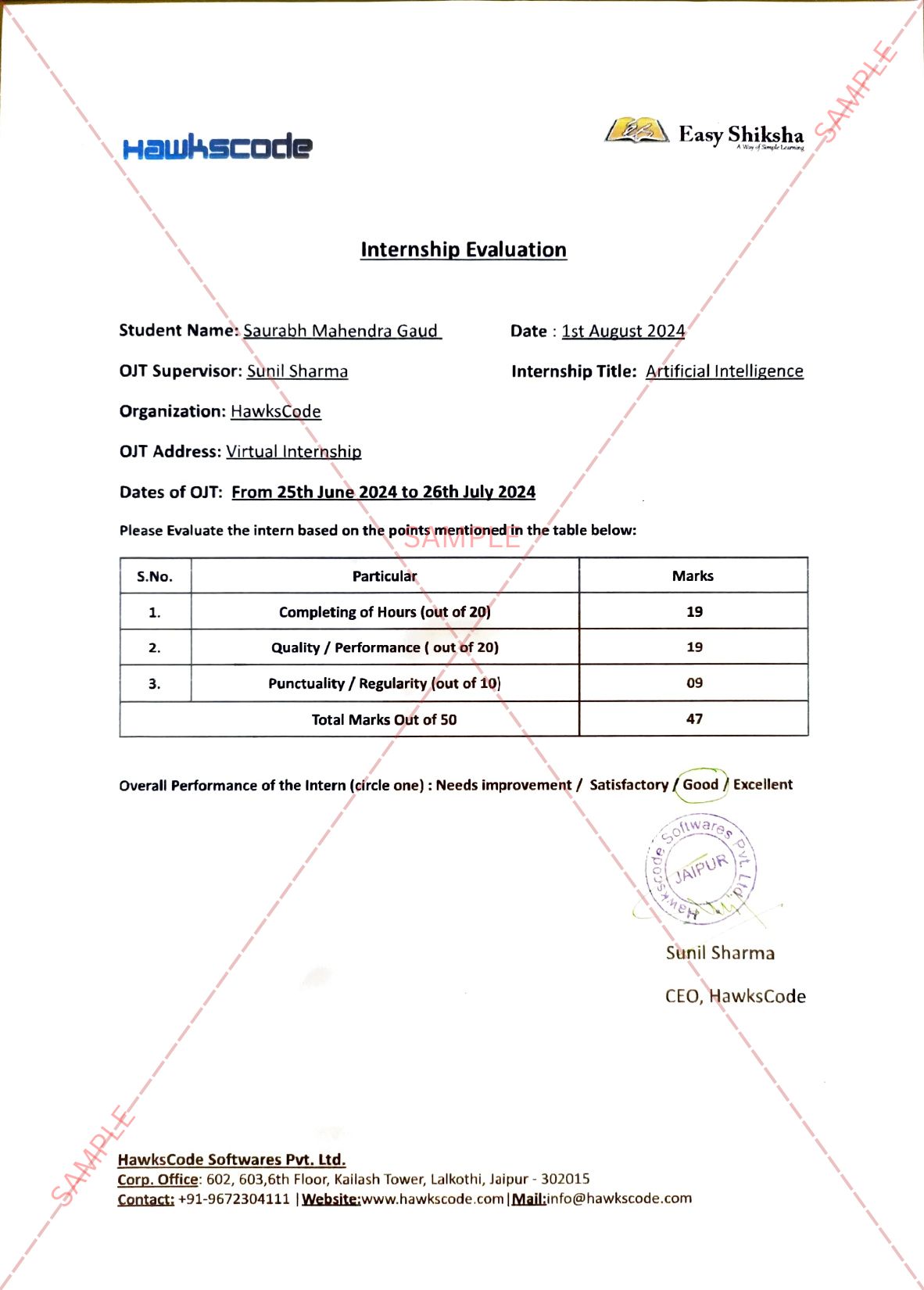

Will I receive a certificate upon completing an internship?

+

Yes, upon successful completion of an internship and payment of the certificate fee, you will receive a certificate.

Are EasyShiksha's internship certificates recognized by universities and employers?

+

Yes, our certificates are widely recognized. They are issued by HawksCode, our parent company, which is a multinational IT company.

Is the download of certificates free or paid?

+

There is a nominal fee for downloading certificates. This fee covers operational costs and ensures the value and authenticity of our certificates.

Do I get a hard copy of the certificate?

+

No, only a soft copy (digital version) of the certificate is provided, which you can download and print if needed. For hard copy certificate contact to our team on info@easyshiksha.com

How soon after course completion do I receive my certificate?

+

Certificates are typically available for download immediately after course completion and payment of the certificate fee.

Are online certificates worthy?

+

Yes, online certificates from reputable platforms like EasyShiksha are increasingly recognized by employers as proof of skills and continuous learning.

How do I know if a certificate is valid?

+

EasyShiksha certificates come with a unique verification code that can be used to confirm their authenticity.

Is a PDF certificate valid?

+

Yes, the PDF certificate you receive from EasyShiksha is a valid document.

Which certificate has more value?

+

The value of a certificate depends on the skills it represents and its relevance to your career goals. Industry-specific certifications often carry significant weight.

Can I get a certificate without completing the course or internship?

+

No, certificates are only issued upon successful completion of the course or internship.