Traditional wealth management/ PFM world was shaken with the advent of so-called “robo advisors” in recent years. ‘Robo-advisor’ is a generic term used to describe a new class of investment advisory service that is offered online, is automated and based on algorithms. This new class of advice started as an offering to occupy the space between self-directed (DIY) investors and human financial advisor recommended investment advice. Further it was considered an ideal advice vehicle for digital savvy millennials. While several robo-advisor startups entered the PFM marketplace, only a few remain standing and have cumulatively attracted only a small fraction of the overall investable assets. But, these robo-advisors have had a bigger impact on the industry. They have forced traditional investment advice firms to evolve and provide automated, low cost investment advice options. Further, robo-advisors have themselves evolved to cater to the B2B market as well as to other areas like retirement plan advice and education plan advice. All this only goes to show that automated advice is still is in its nascent stages and is here to stay in one form or another.

In this course we will cover various topics related to automated investment advice including:

What are Robo-Advisors?

Why does it matter?

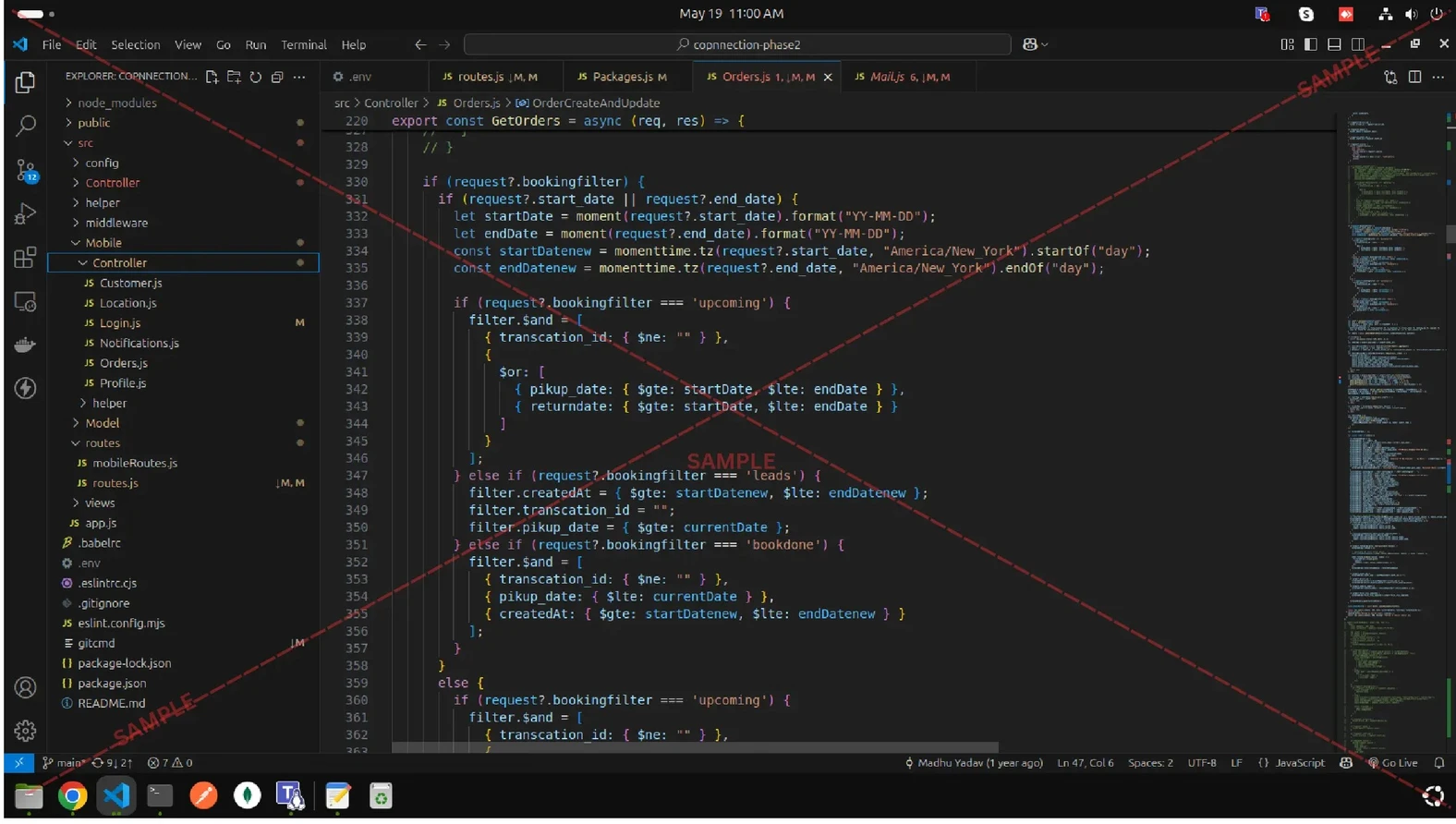

How automated investment advice platform works

Key players and regulation

What to expect in the coming years

Making a business case (Build vs. Buy)

At the end of the course, students will have a better appreciation for the evolving Personal Finance Management (PFM) landscape and its potential. They will understand how automated investment advice products works at its core and what’s needed - building blocks and stakeholders – to offer an effective ‘robo-advisor’ product. They will also become aware of options and opportunities to become involved in this sector.

This introductory course is for anyone who wants to learn about automated investment advice. This is ideal for budding FinTech entrepreneurs, current financial advisors/ RIAs as well as professionals working in traditional financial product distribution firms (broker-dealers, custodians, banks, insurance and asset management companies).

Sumit

-

31 May 2024A very insightful course — explains how robo‑advisors work, different business models, and how digital investment advice is built using algorithms. Great for anyone interested in FinTech or automated wealth management