Central bank of India SO Exam: Eligibility, Application Form, Exam Pattern, Syllabus, Admit Card & Result

Updated On - Oct 1st, 2021

Tom Helson

The Central Bank of India is the largest and oldest bank of India which is wholly owned and managed by Indians. It was established in 1911 by Sorabiji Pochkhanawala. Central Bank of India will release the notification for filling specialist officer posts in its various streams.

Latest updates:

Central Bank of India will release the notification for filling specialist officer posts in its various streams. It will have all the details regarding education, exam date, eligibility, exam pattern, salary, etc

Table of Contents

- Central Bank of India SO Highlights

- Central Bank of India SO Important Dates

- Central Bank of India SO Vacancy

- Central Bank of India SO Eligibility Criteria

- Central Bank of India SO Application

- Central Bank of India SO Exam Pattern

- Central Bank of India SO Syllabus

- Central Bank of India SO Job Profile

- Central Bank of India SO Salary

- Central Bank of India SO CutOff

- Central Bank of India SO Admit Card

- Central Bank of India SO Preparation

- Central Bank of India SO Results

- FAQs

Highlights

Highlights

| Conducting Authority | Central Bank of India |

| Central Bank of India website | https://www.centralbankofindia.co.in |

| Post | Specialist Officer |

| Mode for the application | Online Mode |

| Stages for Examination | Written, interview |

| Exam date | To be notified later |

Important Dates

To be notified

Vacancy

Previous year vacancies

Total 74

| Specialist Category/ Stream | Vacancies |

|---|---|

| Information Technology (JMGS I) | 26 |

| Security Officer (MMGS III) | 01 |

| Security Officer (JMGS I) | 09 |

| Risk Manager (MMGS III) | 06 |

| Risk Manager (MMGS II) | 06 |

| Financial Analyst/ Credit Officer (MMGS II) | 10 |

| Economist (MMGS II) | 01 |

| CDO/Chief Data Scientist (SMGS IV) | 01 |

| Data Analyst (MMGS III) | 03 |

| Analytics-Senior Manager (MMGS III) | 02 |

| Data Engineer (MMGS III) | 02 |

| Data Architect (MMGS III) | 02 |

| CA/Credit Officer (MMGS III) | 05 |

Eligibility Criteria

Age Criteria

As per the notification of the Central Bank of India for giving the exam of specialist officer post, the minimum age requirement is 21 years and the maximum is of 30 years. The age limit is for the general category and in general, age varies from one post to another.

- For Credit Officers/III a candidate must attain the minimum age of 26 years and a maximum of 35 years under the general category and for the reserved category minimum age should be of 26 years and a maximum of 38 years.

- For Risk Manager/ II minimum age should be 21 years and a maximum of 30 years.

- For both Security Officer/I and /III minimum age should be of 26 years and a maximum of 45 years.

- For Risk Manager /III minimum age should be 21 years and a maximum of 35 years.

- For CDO/Chief Data Scientist /IV minimum age should be 28 years and a maximum of 35 years.

- For Financial Analyst/I and Economist/ II minimum age should be 21 years and a maximum of 30 years.

- For Data Architect/III, Data Analyst/III, Analytics Senior Manager/III and Data Engineer/III minimum age should be 26 years and a maximum of 35 years.

- For Information Technology/I minimum age should be 21 years and a maximum of 28 years.

Age Limitation

The Central Bank of India for the SO exam also provides some age limit/relaxation to the reserved categories. A candidate should produce a valid document for claiming age relaxation also, age relaxation varies from one reserved category to another.

- For Other Backward Classes, age relaxation for the candidate given by the Central bank of India is of 3 years.

- Children/Family members of those who died in the year 1984 because of riots are of 3 years.

- Persons domiciled in the state of Jammu & Kashmir during the period from 1980 to 1989 are of 5 years.

- For Scheduled Caste/Scheduled Tribe candidates it is for 5 years.

Educational Qualification

| Post/scale | Qualification | Experience in Years |

|---|---|---|

| Credit officers/3rd | CA/CFA/ACMA/MBA in Finance that should be a regular course from a reputed/recognized college/institute | CA/CFA/ACMA-the experience of 2 years & above in post-qualification of PSBs, Fis, Credit Rating Agencies (Aluminum RS.10000 crore)incorporate credit assessment MBA (finance)-4 years & above in PSBs, Fis, Credit Rating Agencies (Aluminum RS.10000 crore) incorporate credit assessment. |

| Risk Manager/II | B.Tech./MCA with MBA(Finance), M.Sc. Maths, M.Sc. Statistics or its equivalent from a reputed institute/university with an aggregate of 60% marks. | N/A |

| Security Officer/III | A candidate should be a graduate from a recognized university or any equivalent qualification by the Central Government. | Minimum 10 years of experience with Indian Army or service from Air Force, Navy and Military Forces. |

| Security Officer/I | Graduate degree and working knowledge in a Computer system like MS office (word, excel, ppt, etc). | Minimum 5 years of experience as JCO in Indian Army or service from Air Force, Navy and Military Forces |

| Risk Manager/III | MBA in Finance or postgraduate diploma in banking or Finance. | 2 years of experience in Risk Management/Credit/Treasury/ALM. |

| CDO/Chief Data Scientist /IV | Must be graduate from a science background(engineering), statistics, economics, applied science. | Should have expert knowledge in quantitative methods for business and advance data science and 8-10 years of industry experience in data science or business analytics out of which 5 years of experience in banking and financial services. |

| Financial Analyst/II | Passed Examination of institute of charted accountants of India (ICAI), Institute of Cost and works accounts of India (ICWAI) or MBA in Finance from a reputed institute with a minimum of 3years experience as an officer | ICWAI- N/A MBA in Finance-3 years of experience in the public sector. |

| Economist/II | Post Graduate degree in economics/rural economics/econometrics | 3 years of minimum experience in data collection, economic analysis or research. |

| Data Architect/III | Degree in engineering/ science/ advance degree in the analytical field. | Minimum 5 years of industry experience in data science or business analytics role out of which 3 years of experience in banking and financial services. |

| Data Analyst/III | Degree in engineering/science. | Minimum 5 years of experience in data science or IT. |

| Data engineer/III | Degree in engineering/science | Minimum 5 years of experience in data science or IT. |

| Analytics Senior Manager/III | Degree in engineering/science | Minimum 5 years of experience in data science or IT. |

| Information Technology/I | 4 years of engineering degree in computer science/ computer application/IT/telecommunications from a recognized institute. | NA/ |

Application

How to apply.

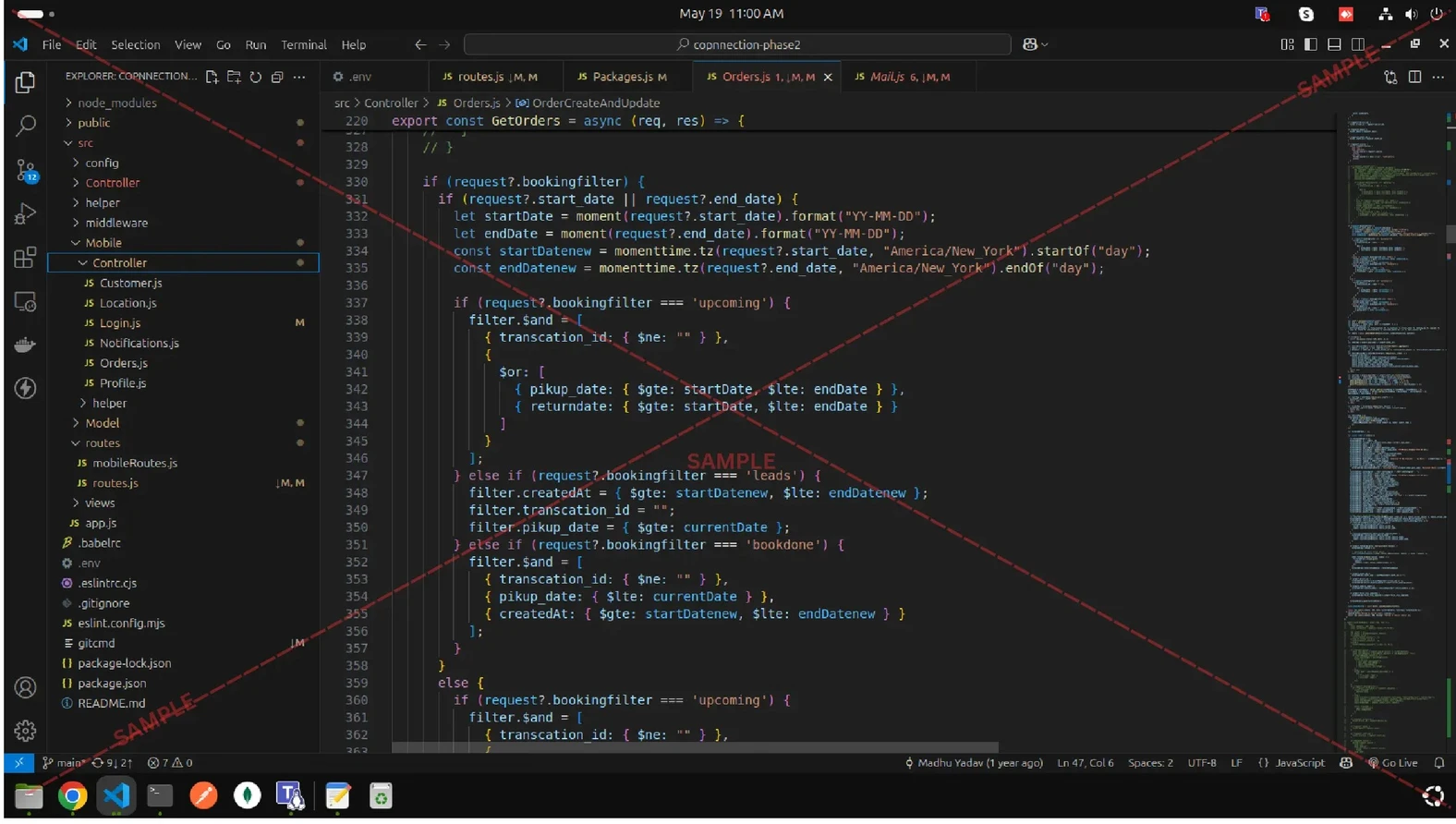

- A candidate must visit the official website of the central bank and first register to themselves. Once registration is completed a provisional password is generated, and they have to use this password for filling the application form.

- Documents required like a signature, passport size photograph, Aadhar card. number, and all the necessary details which will be given on the portal. All the documents should be in jpg/jpeg format and the signature should be on white paper with black ink.

- A candidate should check all his/ her details after the submission, later no correction will be made. Payment should be done through online mode.

- The aspirant must take the printout of the generated e-receipt and central bank of India SO exam application form.

Application fee

- For all other candidates application fee is S.500/- and intimation charges is of RS. 50/- i.e is 550.

- For schedule caste and tribes, there is no application fee for them only intimate charge is there which of RS.50/-

Exam Pattern 2021

The online objective test of the Canara Bank PO 2021-22 will have an equal number of questions from subjects such as Reasoning, Aptitude, General English and General Awareness. There will be 50 questions from each of these sections totalling 200 questions each carrying one mark. The details of the Canara Bank PO exam pattern are given below:

| Subjects | Number of questions | Number of marks |

|---|---|---|

| Stream/ category specific questions | 60 | 60 |

| Computer knowledge | 20 | 20 |

| Banking and general awareness | 20 | 20 |

| Total | 100 | 100 |

For Personal interview

- Once the candidate has qualified for ed the online exam then, he/she will be eligible for the personal interview round.

- A candidate needs to score minimum qualifying marks in each section and in aggregate as decided by the bank.

- A candidate should have all original documents and their Scale-IV xerox prescribed by the bank to produce during the interview of a central bank security officer.

Syllabus

| Sections | Topics |

|---|---|

| Banking, Economic Scenario and General Awareness | Role of the Banking Industry, RBI, All nationalized bank’s history, Types of Banks, Money market in India, Fiscal-Monetary Policies, RBI Functions, Inflation-deflation, Capital market in India, National income and public finance |

| Stream Specific |

|

| Computer Knowledge | History of Computer, Computer Basics Questions, Basic computer terminology, Security Tools, Network basics (LAN & WAN) Computer abbreviation, Virus, Hacking Software names and usages (Microsoft Office) Computer Shortcuts, Computer hardware parts, and controls, Basic internet knowledge and protocols |

Job Profile

- Credit officers/3rd

- Risk Manager/II

- Security Officer/III

- Security Officer/I

- Risk Manager/III

- CDO/Chief Data Scientist /IV

- Financial Analyst/II

- Economist/II

- Data Architect/III

- Data Analyst/III

- Data engineer/III

- Analytics Senior Manager/III

- Information Technology/I

Salary Details 2021

| Senior Manager – Monthly | Rs. 63,473/mo |

| Assistant Manager | Rs. 6,96,297/yr |

| Assistant Manager – Monthly | Rs. 45,021/mo |

Central Bank of India SO: Pay Scale 2021

| Grade | Pay Scale |

|---|---|

| SMG Scale-IV | 50,030-1460(4)-55870-1650(2)-59170 |

| MMG Scale III | 42020-1310(5)-48570-1460(2)-51490 |

| MMG Scale-II | 31705-1145(1)-32850-1310(10)-45950 |

| JMG Scale I | 23700-980(7)-30560-1145(2)-32850-1310(7)-42020 |

Cut Off

Candidates can check their results on the official website of the central bank of India SO that is @centralbankofindia.co.in by filling in the relevant details like registration number, date of birth or password. Also, the cut off marks are prepared based on the category of the candidates, the number of candidates, attended the exam, the number of qualifiers, the previous year cut off-trend and the toughness level of the question paper.

Admit Card

Candidates can download their admit card at the official website of the central bank of India and no hard copy will be sent to the candidates. Also, announcements will be sent by email in the registered email id of the candidates and registered mobile number.

Preparation

Design a study plan

After going through the syllabus and exam pattern, design a study plan. It is imperative to have a good study plan. This will help you structure your preparation. Focus on the sections that need more attention.

Capturing strengths and weaknesses

How can you identify your strength and weaknesses? Well, this can be figured out by solving mock tests and previous years’ question papers. After finding out your strengths and weaknesses, work on the areas that need improvement.

Start preparing early

Once you have made up your mind about joining the banking sector, do not waste time and start preparing for it. It is ideal to start preparation one year in advance. However, many cracked the exams with six months of rigorous preparation. All you need is planning, focus and determination.

Refer to good books

good study material plays an important role. As these are competitive exams, candidates will find ample good books and online reference materials. They should buy them for practice and clearing concepts.

Result

How to Download Central Bank of India SO Result?

- Go to the official website of Central Bank of India https://www.centralbankofindia.co.in

- Click on ‘Career with us’ given at the top right corner of the homepage

- Go to ‘Click Here for the details given under Declaration of written test result for Direct Recruitment of Specialist officers

- Central Bank SO Result PDF will open

- Checklist of selected candidates

- Take a printout for future use

FAQs

Ques. What are the best books to study for the SO exam?

Ans. The candidates can refer to the following books.

Banking and General Awareness

- Static General Knowledge by Arihant Publications

- Guide to Banking General Awareness by R Gupta

Computer knowledge

- Objective Computer Knowledge by R Pillai

- Fundamental of Computer by RPH Editorial Board

Ques. What questions are asked in the Central Bank of India SO Interview round?

Ans. The interview questions vary depending on the posts you are applying for. In general, recruiters focus on your characteristics, communication skills, etc. Other than that, questions related to Indian Banking policies, marketing, financial system are also asked.

Upcoming Exams

IDBI Executive

Sep 4, 2021NABARD Grade B

Sep 17, 2021NABARD Grade A

Sep 18, 2021Notification

IDBI Executive Admit Card 2021 Published on the Official Portal

IDBI Bank has uploaded IDBI Executive Admit Card 2021 on the official website. Candidates who have appeared for Executive posts can refer to the official website of IDBI Bank, idbibank.in to download the same.

Aug 31,2021SBI Clerk Prelims Exam Analysis 2021 for August 29 (All Shifts); Check

SBI has successfully conducted the SBI Clerk Prelims exam in the remaining 4 centers - Shillong, Agartala, Aurangabad (Maharashtra), and Nashik centers in 4 shifts. There were four sections in the question paper.

Aug 31,2021ALSO CHECK